Symmetry

About SYMM

With the ability to invest at a variety of levels, securely store funds, and have input into how a cryptocurrency investment fund is managed, Symmetry Fund (SYMM) is offering investors the opportunity to gain exposure to the cryptocurrency market without the complexities of personally trading it themselves. Part of the Ethereum (ETH) blockchain, SYMM is an ERC20-compliant smart contract. The fund pays monthly dividends in ETH. With a conservative structure and approach, SYMM executes its trades and investments with a balanced and long-term vision for growth.

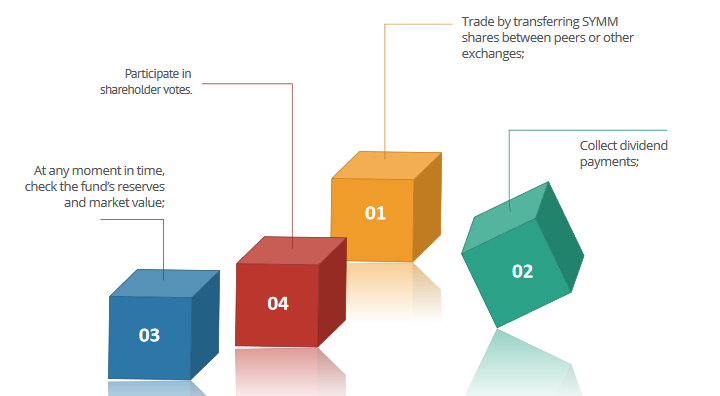

The fund’s capital will be used to trade across a variety of cryptocurrencies and the percentage of the fund that will be allocated to each currency will be determined by analyzing specific currency and signal risks. A single share in the investment fund represents one SYMM token. The investment fund trades and invests in ICOs and cryptocurrencies including Bitcoin, Ethereum, Ripple, Dash and Litecoin. Shareholders will have the ability to trade their tokens with peers based on market rates. This will allow shareholders to cash-out as the fund value increases over time, in conjunction with receiving a monthly ETH dividend.

A fundamental element of SYMM’s risk-mitigation strategy is holding capital in fiat currencies (USD/EUR) when funds are not engaged in a trade. While this may mean the fund is not exposed when large spikes in price occur across cryptocurrencies, it also means the fund is not exposed when volatile moves to the downside occur. This keeps the fund’s exposure to blockchain assets to a minimum and ensures a steady and measured growth trajectory for the fund.

As the initial ICO moves to the trading phase, and the fund becomes more established, SYMM will investigate further opportunities to expand the fund and provide investors with a variety of investments for all risk appetites.

As the initial ICO moves to the trading phase, and the fund becomes more established, SYMM will investigate further opportunities to expand the fund and provide investors with a variety of investments for all risk appetites.

Symmetry Fund (SYMM) ICO

An unlimited amount of SYMM tokens will be released in the SYMM Initial Coin Offering (ICO). The ICO will be open for a period of 60 days at the exchange rate of 0.1 ETH per SYMM. One SYMM token will represent a single share in the fund. From the ICO, most of the funds raised will be used for trading purposes. A small percentage of funds raised (up to 10%) will be held by the fund for prudent reserves and administration. Holding back these funds forms part of SYMM’s risk mitigation measures. An unlimited number of SYMM tokens will be available for purchase at a rate of 0.1 ETH per SYMM during the ICO. By sending Ethereum to the ICO smart contract address, investors will be able to purchase SYMM tokens. After sending the ETH to the address, the investor’s account will be credited with the corresponding amount of SYMM shares. There is no limit on the amount of times investors can purchase SYMM tokens throughout the ICO

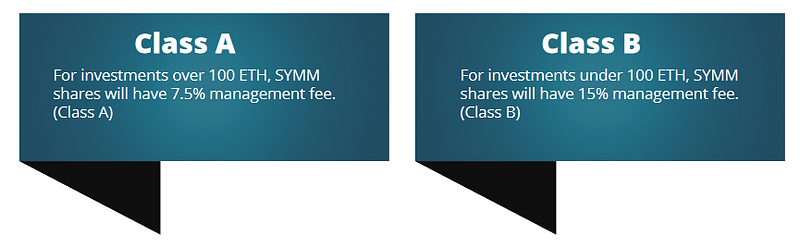

There will be 2 classes of shares:

Moving from ICO to the Trading Phase

The ICO will close manually at the end of 60 days. It can be closed by a nominated administrator account. After closure of the ICO, the funds will be withdrawn from the contract and exchanged to fiat currencies. To ensure that SYMM does not have an adverse impact in the markets that it will trade in, withdrawals from the ICO phase will be completed over a period of days or weeks. The withdrawals will be completed on a range of different exchanges to further mitigate potential market impacts.

Summary of the SYMM ICO

-One SYMM share is equal to one ERC-20 compliant token.

- The duration of the ICO is 60 days from November 30, 2017 to January 30, 2018..

- During the ICO, 1 SYMM share will cost 0.1 ETH.

- The ICO Soft Cap is 3,000 ETH.

- There is no Hard Cap for the ICO.

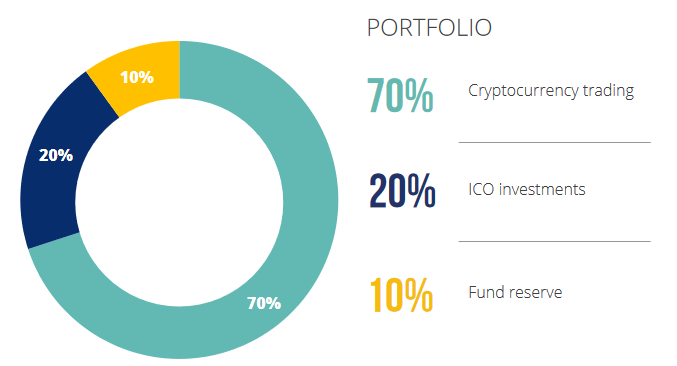

- Trades in BTC, LTC, DASH, ETH and XRP will be conducted using 70% of the fund’s capital.

- 20% of the fund will invest in high potential ICOs. SYMM will secure a deep discount (up to 50%) on

- ICOs that have not yet been released for public sale.

- 10% of the fund will be held by the fund in a reserve to ensure that the whole fund is never exposed at any point in time.

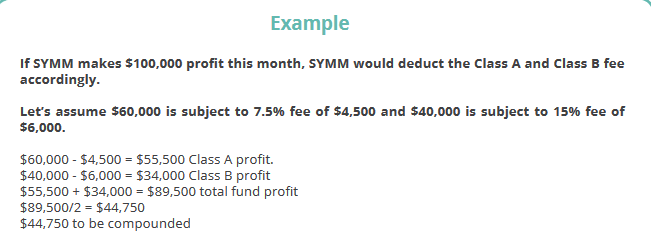

- 50% of monthly trading profits will be paid in dividends to investors each month. Dividends will be paid in ETH.

- 50% of monthly trading profits will be held for compounding growth.

- To reduce risk and ensure stability of the fund’s value, SYMM funds will be held in USD and EUR.

- Risk mitigation strategies will be established.

- Management fees will not be charged if there are no profits.

- Based on Symmetry scenarios and fund projection, the estimated annual ROI for SYMM investors is expected to be more than 50%.

- All shareholders will have the opportunity to vote on major fund decisions, further fostering trust and sparency between the fund and its shareholders.

- All trades that SYMM execute will be detailed on the relevant exchanges.

- Funds held by SYMM will be subject to external auditing each month.

- Accounts balances and SYMM fund value will be reported to shareholders daily.

- Until SYMM is listed on major exchanges, all shareholders will have the ability to sell their investment for instant liquidit

The Trading Phase

After the ICO successfully closes and funds are withdrawn from the ICO, the trading phase will commence. The trading phase will continue indefinitely with changes in trading activities such as pairs traded and fund allocation to be voted on by shareholders.

At the commencement of the trading phase, the capital value of SYMM will come from 90% of the capital raised in the ICO. This capital will be converted into fiat currencies and quoted in USD.

Risk Management in Trading

Risk will be proactively managed by SYMM. A key strategy SYMM will employ to mitigate risk is storing SYMM’s capital in fiat currencies when not engaged in a trade. SYMM funds will only be held in cryptocur — rencies throughout the duration of trades.

Holding funds in fiat currencies means the value of the fund will experience consistent growth without being constantly exposed to the, often volatile, fluctuations of cryptocurrencies.

Dividends

When SYMM makes a monthly profit, dividends will be paid to shareholders in ETH via a smart contract on the 3rd day of the month. Dividends will be immediately available to SYMM investors when the payment is sent to the dividend contract. Investors can then withdraw funds at a time of their choosing.

Technology

As a technology company, SYMM offers individuals the opportunity to gain exposure to the cryptocurrency market without the complexities of managing their own trades and associated technology. Embedded in the ETH blockchain, SYMM is an ERC20-compliant token.

It is embedded in the ETH blockchain as a smart contract. Other financial functions of SYMM will also be supported by contracts on the blockchain including management of the ICO, dividend payments, transparency measures, and voting.

There are several smart contracts that will operate throughout different phases in the SYMM fund from the ICO phase to the trading phase. These contracts deal with different parts of the fund. For example, when an investor purchases SYMM shares in exchange for tokens in the ICO phase, the contracts will execute the action of providing SYMM shares in exchange for tokens.

The Future of SYMM

Other base currencies and trading pairs will be launched by SYMM as the fund becomes more established and the trading phase of this initial ICO has matured.

The aim of SYMM is to be able to provide a variety of risk levels for investors so there is a solution for every investor interested in having exposure to cryptocur- rencies. As we launch new investment opportunities, and expand the fund, SYMM will investigate how it can provide current investors with special offers and benefits for new offerings.

MyBitcointalk: https://bitcointalk.org/index.php?action=profile;u=1116298

Comments

Post a Comment