Hada Dbank - Islamic Banking

DBANK is the first Digital Bank to incorporate the Sharia Banking Module with Blockchain Technology, to create an ethical and responsible banking ecosystem. We are troubled by the current bank and financial institution persecution of their customers. Existing players make money out of thin air from debt and interest. This is why the global economy has collapsed over time, evident since the 1st century. The lack of responsibility charged by banks is brave enough. This is why the Bank’s revolution through the establishment of a Bank, a caring and personal bank.

Caring and Personal: this is our core value, shaping and influencing services, transactions, interactions and running our business. These words will guide our behavior internally within our organization, and externally with our customers and society. We aspire to be a bank that really cares to improve people’s lives, not just profit from it. Personalization will also be the main focus of our services. Different customers have different needs, and require different services and attention. Customers HADA DBANK will have a customized service because we believe, not everyone can wear the same pants.

We aspire to be a ‘fair’ organization in the financial industry. The 2007–2008 financial crisis serves as a grim reminder of how some irresponsible players can replace an entire industry, leaving millions of people in financial ruin. Sharia banking, because of transparency, the concept of sharing profit and loss, will minimize market manipulation and eliminate other domino clashes.

The DBANK HADA team , will develop a comprehensive Blockchain Digital Bank that will make life easier for everyone, regardless of their status. They will be able to perform banking activities at a cost of 0% and at the same time enjoy our quality service. We are here not just for profit, but to make a justified profit while ensuring a better banking experience.

HADA DBANK will become the world’s first Blockchain-based Digital Bank to integrate Shariah Banking Module with Blockchain Technology, to create an ethical and responsible banking ecosystem. As our existing Digital Bank and newly created Blockchain Bank focus on Conventional Banking services, we chose to win Islamic Banking services due to the lack of such facilities. In 2016, sharia banking is worth USD 1.5 trillion globally.

Islamic banks are less risky and tougher than their peers, due to the aspect of their capital needs and the mobility of their bank deposits. Unlike Conventional Banking, deposits to Sharia Banks are entitled to be informed of what banks do with their money. They also have a vote in which their money should be invested. Islamic banks also seek to avoid interest at all levels of financial transactions and encourage risk sharing between lenders and borrowers.

There are two basic principles in sharia banking. One is the sharing of profits and losses; and two, significantly, the prohibition of interest collection and payment by creditors and investors. Collective interest or “Riba” is not permissible under Islamic law. In terms of profit, both the bank and its customers in the form agreed upon. In case of loss, all financial losses will be incurred borne by the lender. In addition, Islamic banks can not create debt without goods and services to support it (ie physical assets including machinery, equipment, and inventory). Therefore, our deposits, deposits and investments with DBank will be supported by physical assets such as precious metals and gemstones.

SECONDARY MARKET

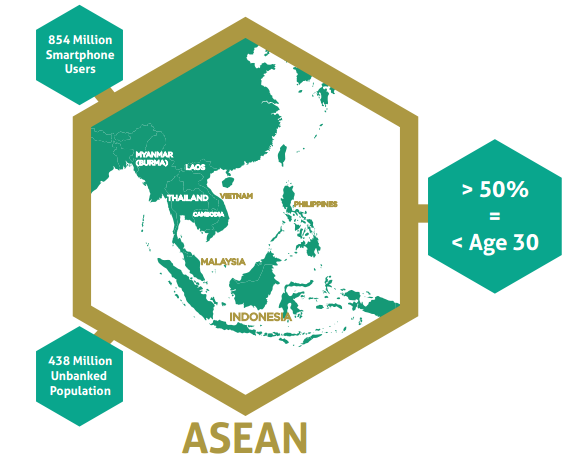

Apart from the Muslim population of 1.7 Billion and billions of others who prefer to subscribe to Islamic Banking services, DBANK’s HADA will also focus on a population of 644.1 million people in Southeast Asia (ASEAN).

Interesting facts about ASEAN:

Has a population that is not budgeted about 438 million.

More than half the population in ASEAN is under 30 years of age.

Has a market penetration of 854 million smartphones or 133% compared to the population, but only 53% of ASEAN population is online, leaving significant space for future market expansion in Indonesia.

As a special bank Online, this fact convinces us to focus on ASEAN as our secondary market. We are scheduled to offer our Syariah Banking Services gradually in the second Quarter of 2018.

FEATURES AND EXCLUSIVE BENEFITS

with e-Wallet or Debit Card and change it to cash or cryptocurrency / token to spend more. Use it as an additional discount to pay for whatever you want and save more on your purchase. You can also use points collected to exchange anything you like at partner e-malls or physical outlets around the world.

Bonus Referral or Bounty when your referrals register with us through your Referral Code.

TECHNOLOGY IN DBANK

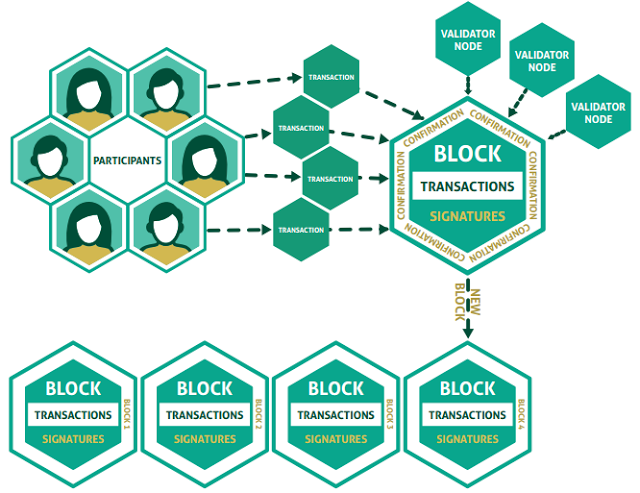

HADA DBANK uses private blockchain that is stored on every node in the network. By default, all nodes are controlled by DBANK HADA. Some nodes only store copies of blockchain and do not take part in the transacton confirmation process (consensus protocol). The node can act as a gateway node or backup server. A node that acts as a validator can be found on a secure network segment of the bank and available through the gateway node.

The core core database is implemented in a blockchain structure, where each block is a set of transactons. Each new block defines the new core state according to the previous block state. The core database integrity is provided by blockchain and consensus on it. Each block is connected cryptographically to the previous block. This feature ensures the ability to validate the database and history of transactons on each tme in the future. The primary database stores all the data that passes its core.

ABOUT HADACOIN

We intend to raise capital for the development of DBANK HADA through its HADACoin. Buyers will be able to use HADACoin to conduct banking transactions or daily activities. Our customers will be issued with a Debit Card, which enables them to transact with our HADACoin, within the banking platinum or other merchants around the world.

Website: https://www.hada-dbank.com/

Bitcointalk Ann Thread: https://bitcointalk.org/index.php?topic=2611797.0

My username: btcs-favorite

Comments

Post a Comment